I recently built Delta Neutral, a self-hosted concentrated liquidity hedge rebalancer.

In Uniswap v3-style concentrated liquidity pools, liquidity providers pool two assets within a bounded price range. The position is not static: as price moves within the range, the pool continuously rebalances the asset composition. This means your effective exposure per asset drifts over time.

If you want to hedge a CL position, you can open shorts against the underlying assets. The complication is that the required hedge size is itself dynamic. As the pool composition changes, a fixed short quickly becomes misaligned, leaving the position over or under-hedged.

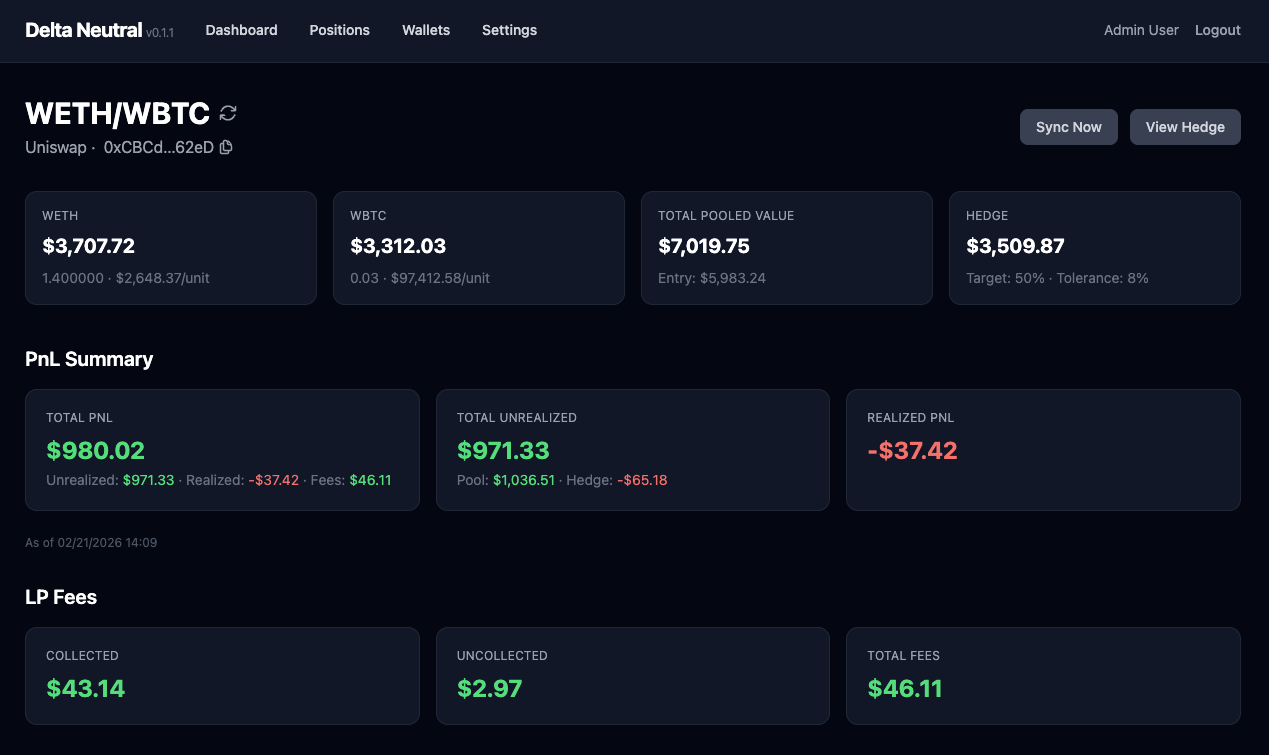

Delta Neutral automates this hedge rebalance process. I'm very excited to launch this for myself after painstakingly monitoring shorts manually and recording the outcomes via Google Sheets. The application monitors your Uniswap v3 positions, derives the current asset balances implied by the position, and compares those balances against your configured hedge targets. When the live short diverges beyond a specified tolerance, the system closes the position and reopens it at the correct size.

I typically run a 50% hedge with a 5% tolerance. If one of my assets in the pool is ETH, and the current pooled amount is 10 ETH, then the target short is 5 ETH. As price movement shifts the pool composition, the application watches for drift. If my pooled amount becomes 5 ETH, I need my short to be 2.5 ETH to maintain my 50% hedge. Once the live short moves outside the tolerance band relative to the current target, the position is automatically rebuilt to restore alignment, and I receive an email notifying me of the rebalance. Additionally, PnL is tracked over rebalances and market fluctuations.

The application is designed as a self-hosted Rails service. You deploy it with a Hyperliquid private key and the necessary API access for Uniswap and other on-chain data sources. On startup, you provide a wallet address, and the app syncs the associated Uniswap v3 positions. From the UI, you can attach hedge configurations to individual positions and allow the rebalancer to manage the shorts automatically.

Exchange interaction is handled through my Ruby Hyperliquid SDK, which provides the signing and order actions against Hyperliquid's API.

Code is available here:

Hyperliquid SDK:

https://github.com/carter2099/hyperliquid

Delta Neutral:

https://github.com/carter2099/delta_neutral